Protect your business by conducting background checks in minutes

Check online the background of your users, employees and suppliers. Get reliable results to make decisions and grow your business.

Types of background: criminal, judicial, police, credit and international, among others.

Types of verifications: personal, vehicular and business.

Why check court records with Truora?

We offer you up-to-date and accurate information to help you ensure the reliability of your business relationships:

Increase the security of your business and prevent fraud

Access +2000 official sources of information in real time to check online background of people, vehicles and companies

Comply with regulation

Save time and resources

Easily perform bulk queries

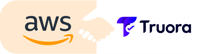

What can you achieve with Truora's judicial background check?

You will have available sources of official information classified in different data sets, thus guaranteeing reliable results:

- Personal identity

- Criminal and criminal records

- Judicial background

- International charts

- Professional history

- Affiliations and insurance

- Credit history

- Taxes and finance

- Media alert

- Vehicle history

- Company background

By entering just one or two pieces of information about your users, you'll be able to run a background check in minutes.

Once the search is complete, we will provide you with a detailed report.

- Download detailed reports that include information on criminal records, trials and other relevant records.

- Monitor queries periodically and access risk alerts in each query you make.

- Make your own decision rules with our technology and make decisions in real time.

Keep your business confident with Truora

official databases

Learn how our customers use verification

Secure contracting with accurate information

Rappi decreased the entry rate of unqualified candidates, ensuring the registration of real Rappi-Shopkeepers to the App, thanks to the massive validation of background in criminal and civil lists nationwide.

Industries:

Automation of risk models for granting loans

Through Truora's background check process, ExcelCredit has been able to obtain a credit score from its users to decide whether or not to grant credit, quickly and safely.

Industries:

Compliance with regulatory regulations

Leal periodically checks the background of its employees and suppliers to comply with the regulatory requirements of SARLAFT and SAGRILAF.

Industries:

Start protecting your business:

We have more than 2000 official sources of information in LATAM, to help you protect your business.

Know the main databases by country:

Colombia

- Identity: citizenship card, driver's license.

- Judicial and criminal records: National Police, Attorney General's Office, Judicial processes.

- Business background: Single Tax Registry, Superintendence of Companies, Single Business and Social Registry.

- Other records: International lists, traffic fines, SOAT, politically exposed persons (PEP).

México

- Identity: National Electoral Institute, National Population Registry (RENAPO).

- Judicial and criminal records: Federal and state judiciary, Federal Judicial Council.

- Business background: SAT Certificates.

- Other records: International lists, traffic fines, public vehicle registry, politically exposed persons (PEP), traffic licenses.

Brazil

- Identity: Proof of Cadastral Situation No CPF, Validation of Identity with private deed.

- Judicial and criminal record: Banco Nacional de Monitoramento Penitenciário, Justiça Federal, Certidão Criminal Polícia Federal, Superior Tribunal de Justiça, Supremo Tribunal Federal, Tribunal Regional Federal.

- Other registries: international lists, PEP, SERASA.

Chile

- Identity: Internal Revenue Service, ChileAtiende, Birth Certificates, driver's licenses, RUT, Civil Registry and Identification Service.

- Judicial and criminal record: Supreme Court of Chile, Legal Data Chile, Judiciary, International Police of Chile.

- Business background: Withholding Agent - Internal Revenue Service.

- Other records: international lists, traffic fines, vehicle circulation permit, self-insurance.

Perú

- Identity: Passport, National Registry of Identification and Civil Status, Social Security of Health of Peru, Rutifier Peru.

- Judicial and criminal background: Ministerio de Justicia de Peru, Poder Judicial del Perú, list of most wanted fugitives, Registry of Debtors.

- Business background: Rutifier Peru, National Superintendence of Customs and Tax Administration.

- Other records: traffic fines, driving license, comprehensive health insurance, National Superintendence of Higher University Education.

Costa Rica

- Identity: National Registry, Public Consultation of Electronic Files of Costa Rica, Supreme Court of Elections Republic of Costa Rica.

- Judicial and criminal background: Judicial Power of the Republic of Costa Rica, Judicial Investigation Organism.

- Other records: Consejo de Transporte Público Costa Rica, Ministerio de Hacienda.

International Lists

- FBI

- INTERPOL List of the most wanted

- U.S. Terrorist List

- Most wanted fugitives de la DEA

- U.S. Security and Exchange Commission (SEC)

- United Nations Security Council Consolidated List

- World Bank Debarred Firms

- EU List of the most wanted

Are you sure who your users are?

Check your court records with Truora and get the information you need to make informed decisions.

They trust our background check

Guarantee trust and security

.webp)

Maintain the security of your company: start now

Comply with regulations and protect both your business and your customers and employees, accessing our plans for background checks.

Need help or want more than one product? Talk to sales

Plans according to the volume of checks

From 10 checks per month and up to +6000 checks per year

Check online the background of your users, employees and suppliers.