Fintech industry: onboard customers effortlessly and protect your fintech from fraud

Reduce manual validation processes and facilitate a quick and secure onboarding of new customers

FINANCIAL INSTITUTIONS THAT TRUST TRUORA

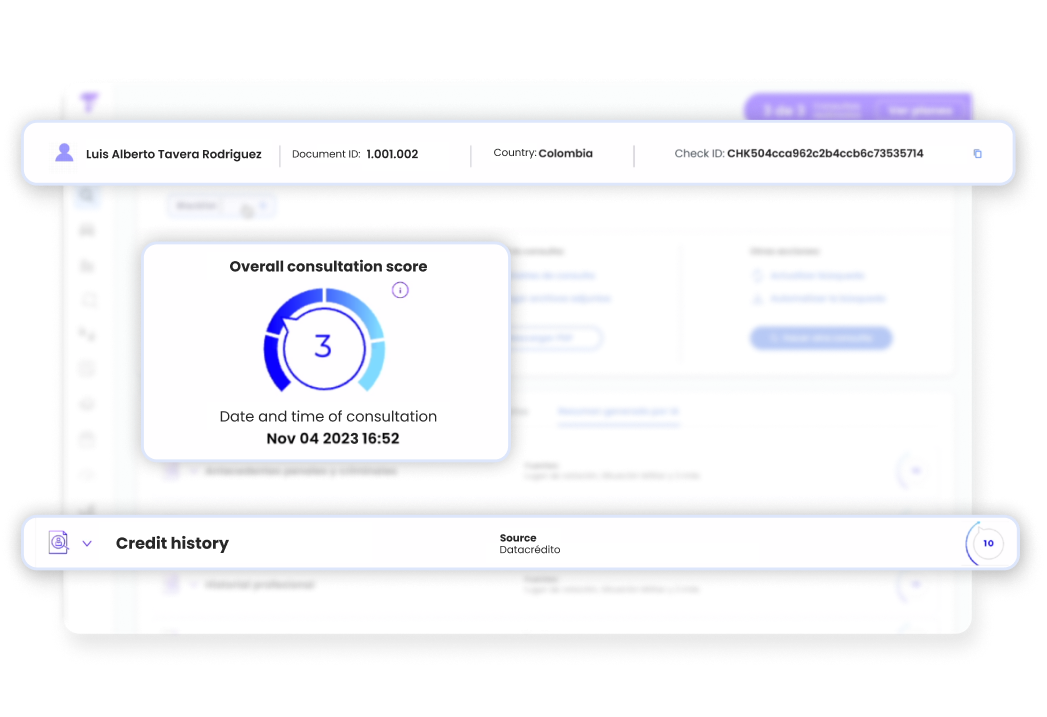

Secure, fast and stress-free identity validation

Accelerate growth by acquiring reliable customers and validating their identity with high precision

Comply with the regulations required for fintechs

Avoid sanctions by complying with KYC and AML regulations

Automate decisions and save time

Establish automatic customer verification rules

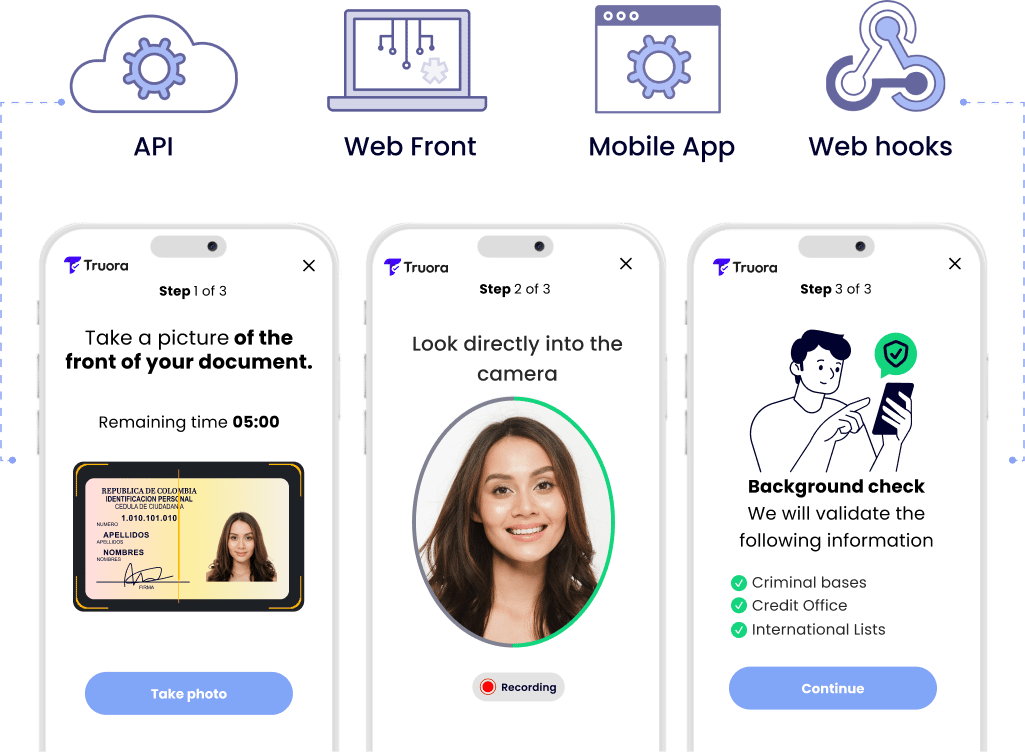

Integrate easily to your services

Ensure a consistent, intuitive and secure experience

Eliminate digital barriers and easily verify your customers

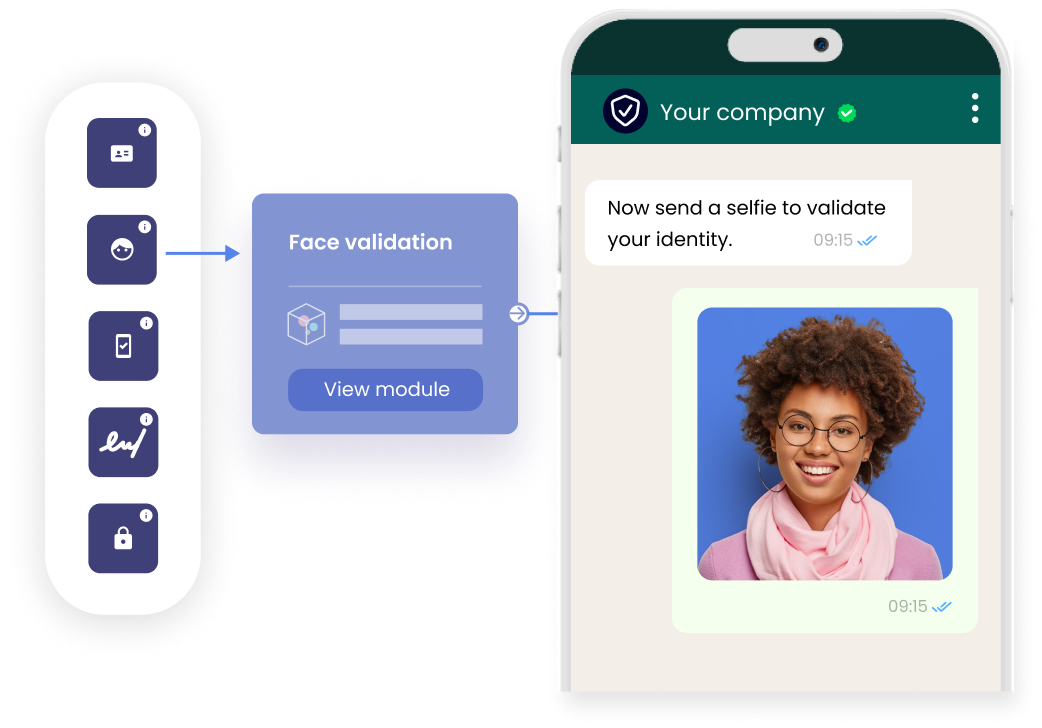

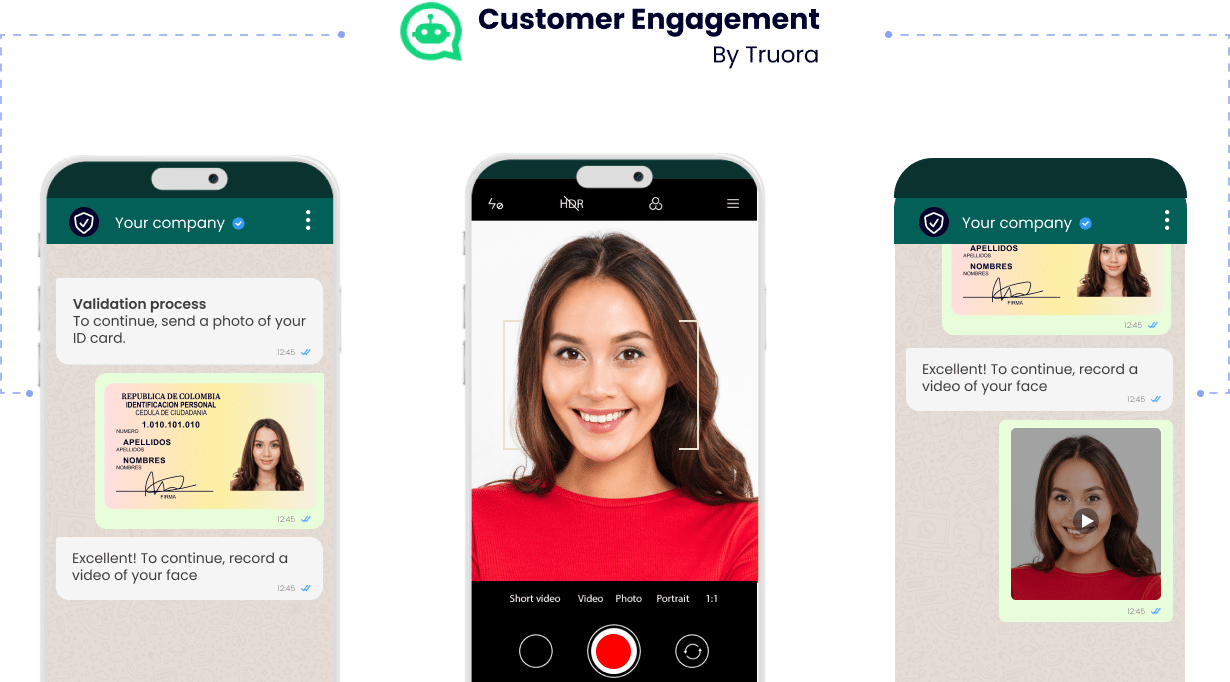

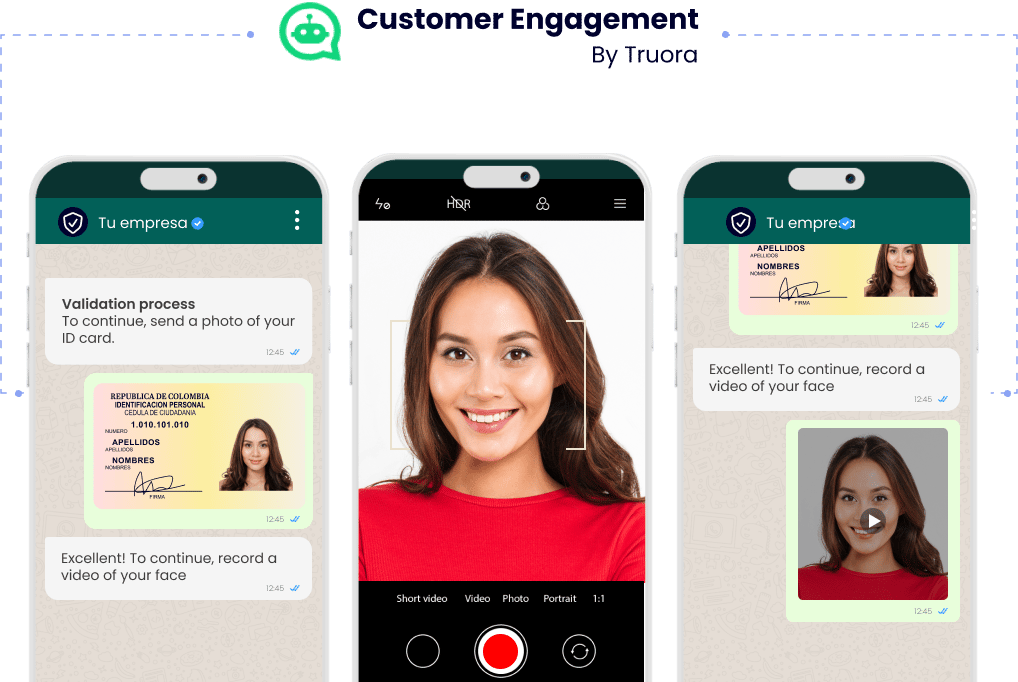

Activate digital validation flows as simple or comprehensive as needed. You can include checks for:

-

Personal, criminal, and credit history

-

Identity document

-

Facial recognition / Selfie

-

Residence address, phone number, and email

All within minutes, integrated into your services, and with a guided experience for your customers, avoiding drop-offs.

Validate identity in real-time for your BNPL services

Facilitate customer verification in retail - buy now and pay later - allowing access to trustworthy individuals and complying with KYC and AML regulations.

Ensure that your customers are who they claim to be and know their background before incorporating them into your services.

Achieve a higher contact rate with your debtors and reduce human intervention

Enable friendly reminders and facilitate on-time payment from your customers without the need for repetitive processes or long calling sessions. Configure automatic responses and let the bot handle collections for you.

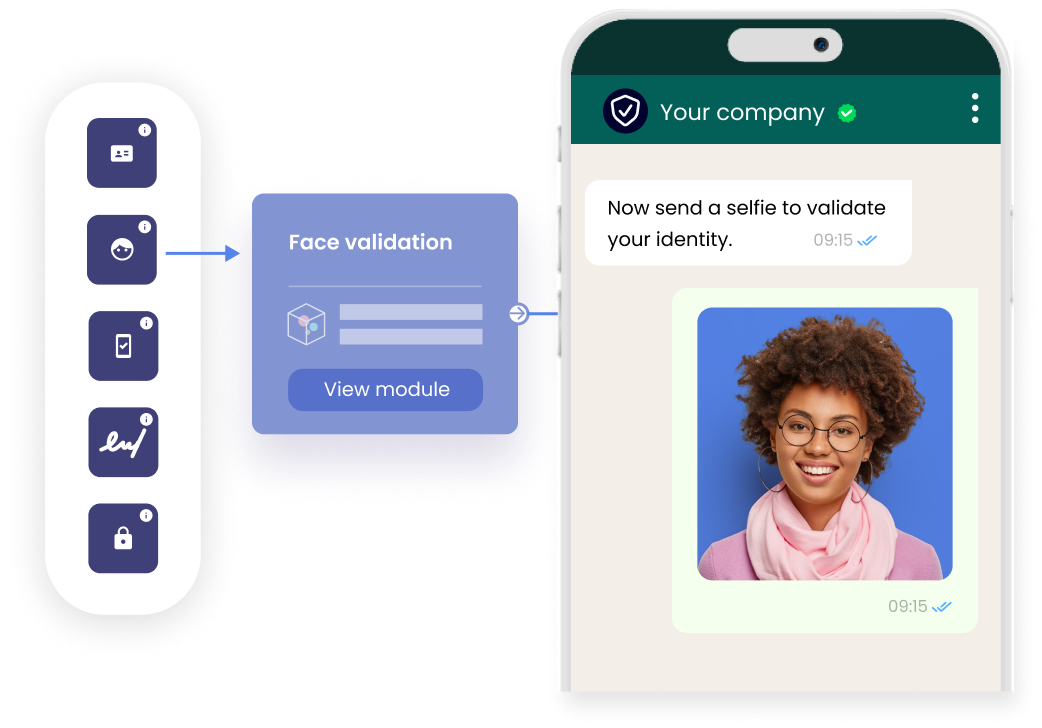

Detect risks and monitor who enters your financial services

Assign automatic decision rules and monitor any changes to avoid risks in your bank, reducing response times and operational costs.

Obtain key data and information to profile your audience, identifying opportunities for your financial services.

Integrate an efficient and comprehensive validation experience

Which also works on WhatsApp

Learn how Truora helps Fintech Industries grow more

Request a free consultation with our team of experts.

Discover our impact on other companies

Luis Velasco

Maria Fernanda Bonilla

Diego Lopez

Felipe Villamarin

Diego Torres

Ensure security and trust

.webp)