Maximize conversión of digital pricing and insurance sales journeys

Create conversational flows that allow you to focus on what is most important: selling. vender.

FINANCIAL AND INSURANCE COMPANIES THAT TRUST US

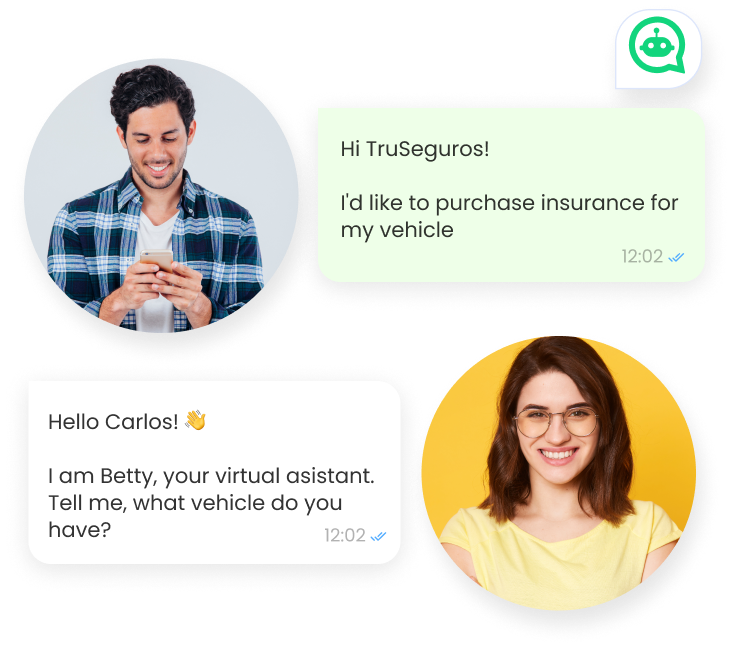

Create automated conversational flows to grant life and non-life policies

And connect with your potencial clients where they already are

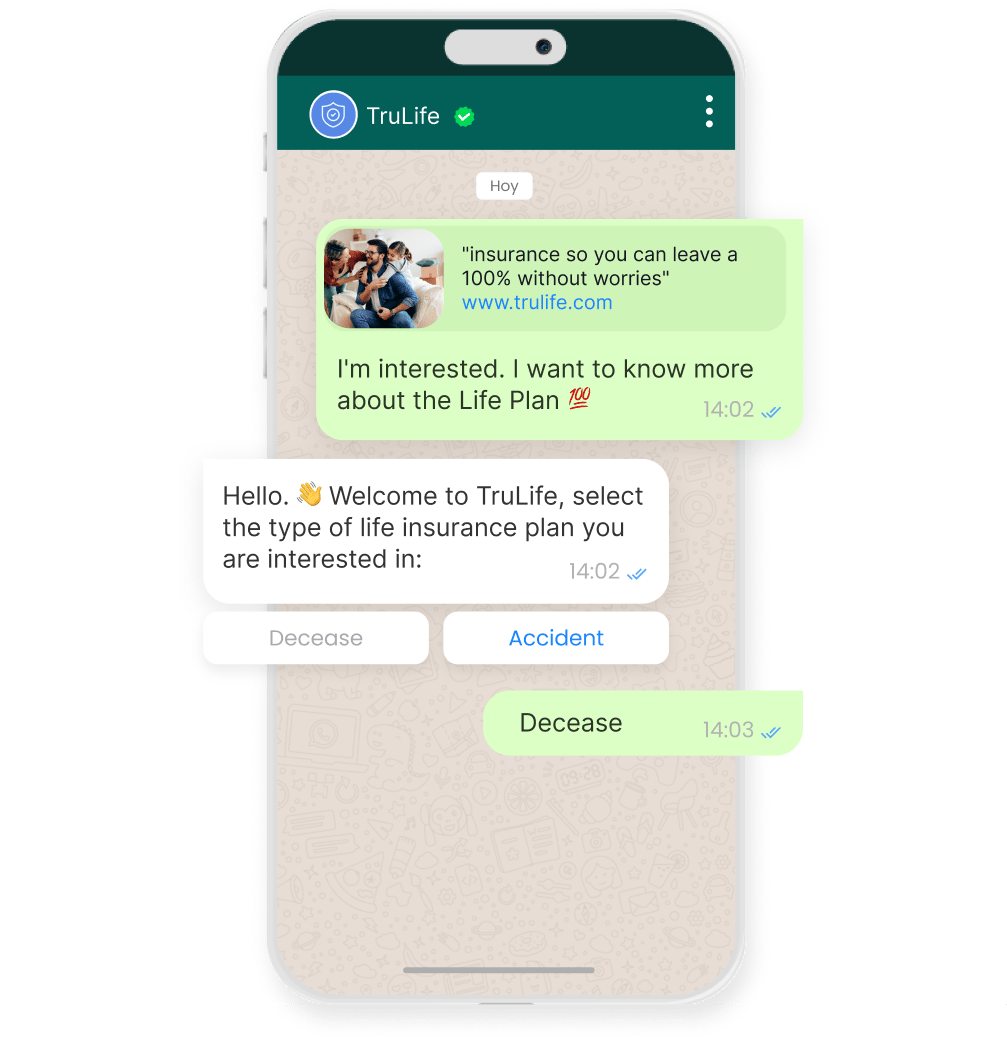

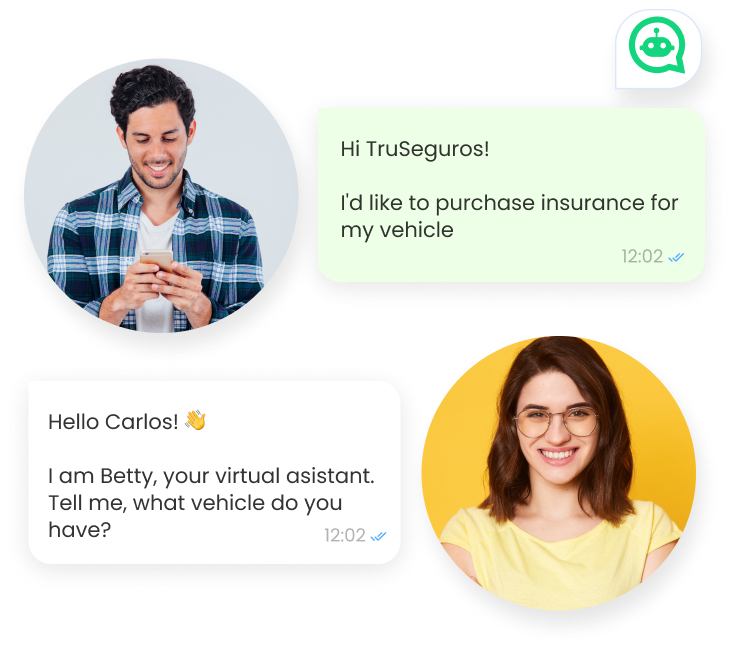

Profile your customer and optimize

conversation management by efficiently collecting key customer information

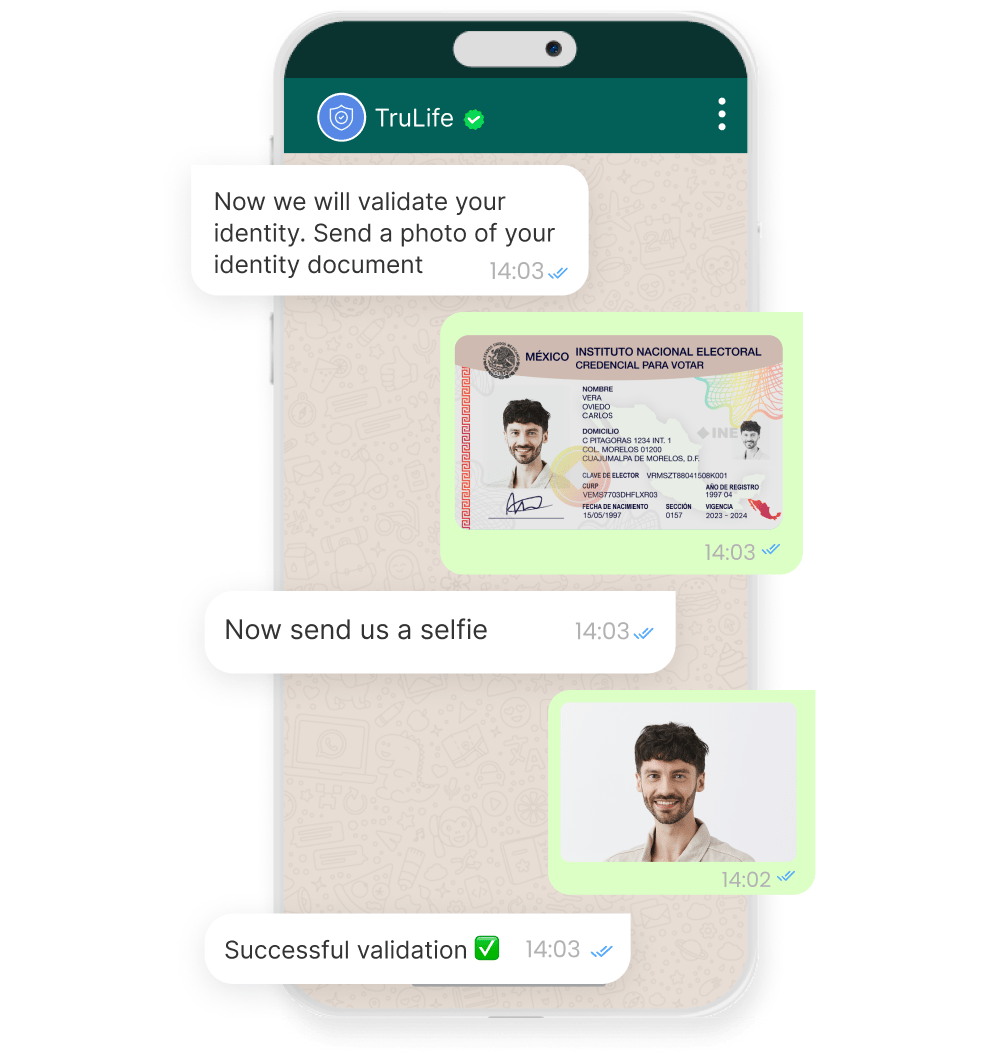

Validate if your costumer if trustworthy

by adding background checks and identity validators in the chat

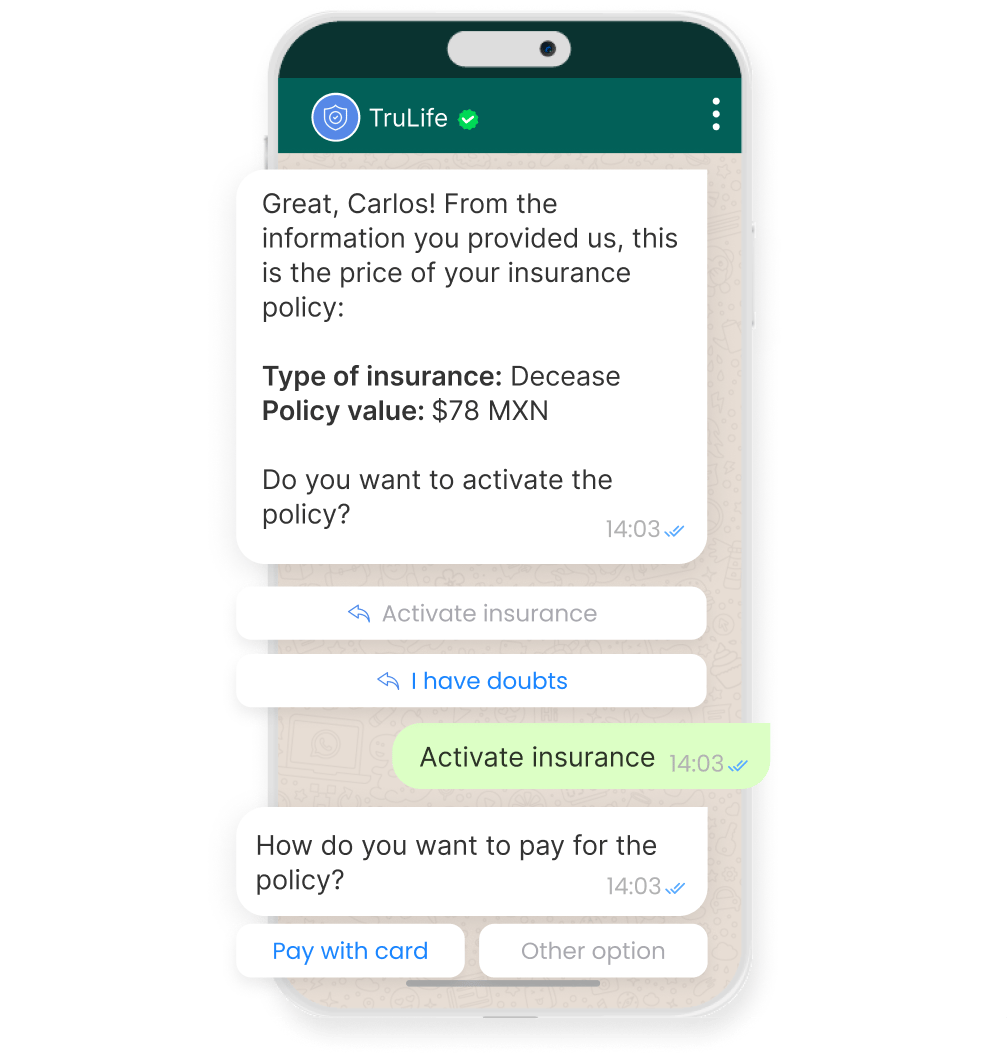

Provide the appropiate insurance

adapted to the specific necessity and with the best user experience

-

+60%

conversion

-

24/7

available asynchronously

-

4X

less CAC

From the first click, al through the final purchase of an insurance

Draw in more customers with conversational flows that gather the necessary information to provide the right insurance to the correct client, applicable to any digital journey your clients follow.

-

Perfilar y calificar clientes

-

Vender o renovar pólizas de vida y no vida

-

Solicitud de reembolso y reporte de siniestros

-

Soporte a usuarios y preguntas frecuentes

-

Recuperar usuarios perdidos en el embudo

Create automated conversational flows that allow you to:

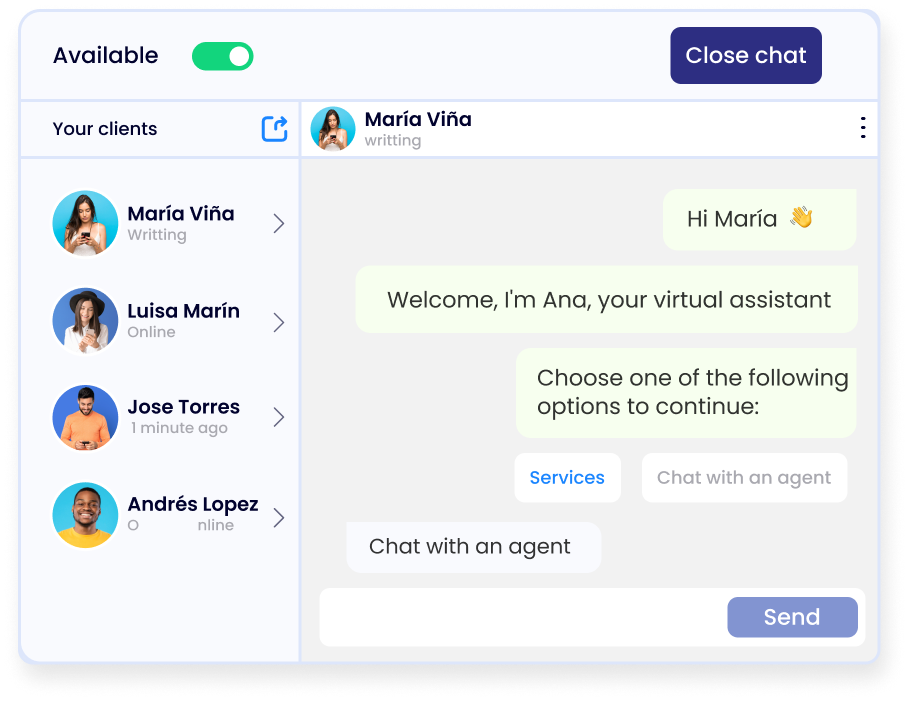

- Take control of the conversation with an agent the moment you need to.

- Visualize the sales funnel in real time so your agents can manage and make decisions.

- Add identity validation components, simplifying the proces and creating secure interactions.

Save costs and improve the user experience

With Truora you simplify your operation and boosts your agent's productivity with technology that allows them to eliminate repetitive operational activities.

- Save time and avoid displacements by digitilizing the interactions with your clients.

- Automate payment reminders and responses to frequent questions with the help of AI.

- Simplify the signing and sending of documents and contracts at the moment of closing the sale of a policy..

With the security and trust you need

.webp)

eBook

Practical guide for insurance companies: why choose WhatsApp as an alternative acquisition channel?

eBook

Practical guide for insurance companies: why choose WhatsApp as an alternative acquisition channel?

Learn how Truora helps you with your processes

Request a free consultation with our team of experts

See how our clients make an impact

Luis Velasco

Maria Fernanda Bonilla

Diego Lopez

Felipe Villamarin