We offer a set of validation methods for you to choose from

All of our validators work independently or together, enabling a more secure, efficient, and customizable validation process tailored to your business needs.

You choose the best experience for your users:

Validation via web/app

You choose which validators to use and in what order

- Document Validation

- Facial Recognition

- Phone Validation

- Email Validation

- Forms

- Comprobante de Domicilio

Validation via WhatsApp

You choose which validators to use, in which chat, and in what order

- Document Validation

- Facial Recognition

- Data Capture

- Email/Phone validation

- Proof of Address

- Voice + Face

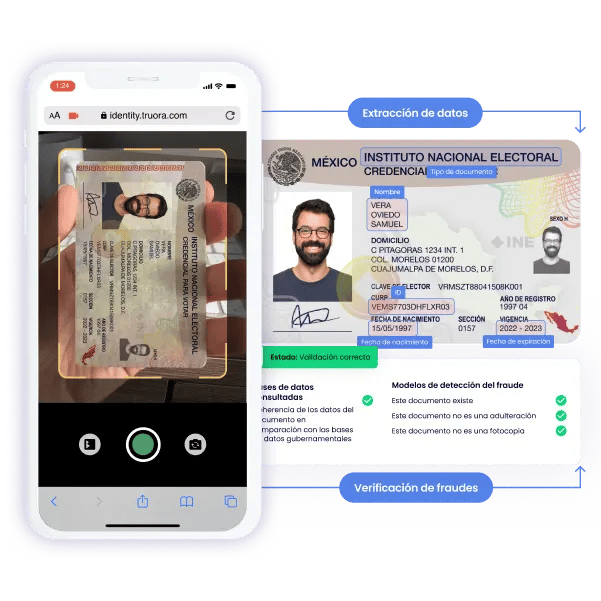

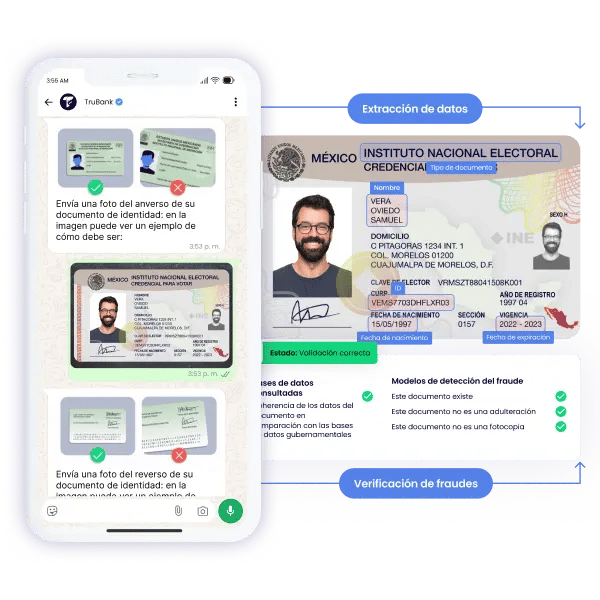

Verify the authenticity and consistency of users’ identity documents

We use intelligent algorithms to verify the authenticity of documents, detecting even the most sophisticated forgeries using OCR technology.

Suppoorted documents:- INE/IFE ID

- FM2/FM3 Residence Card

- Passport

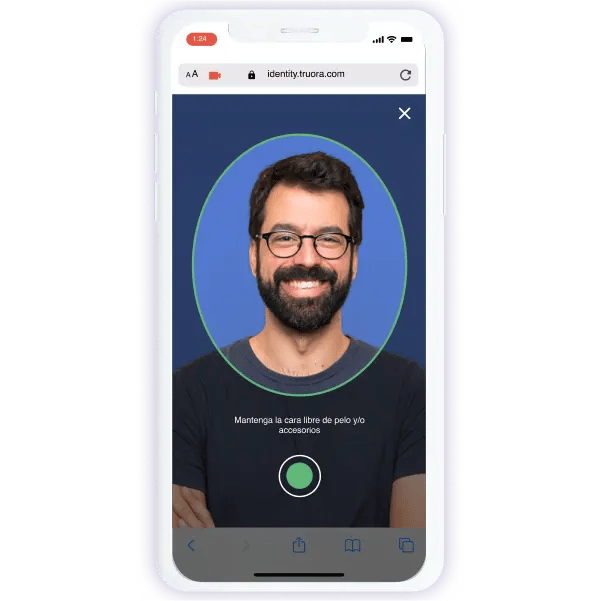

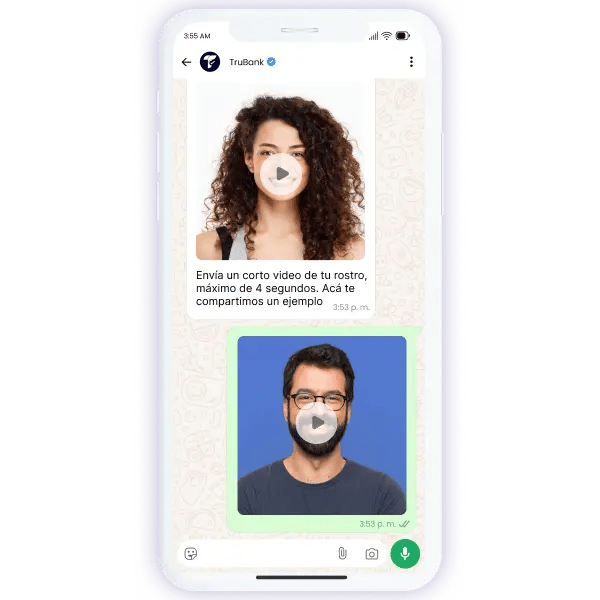

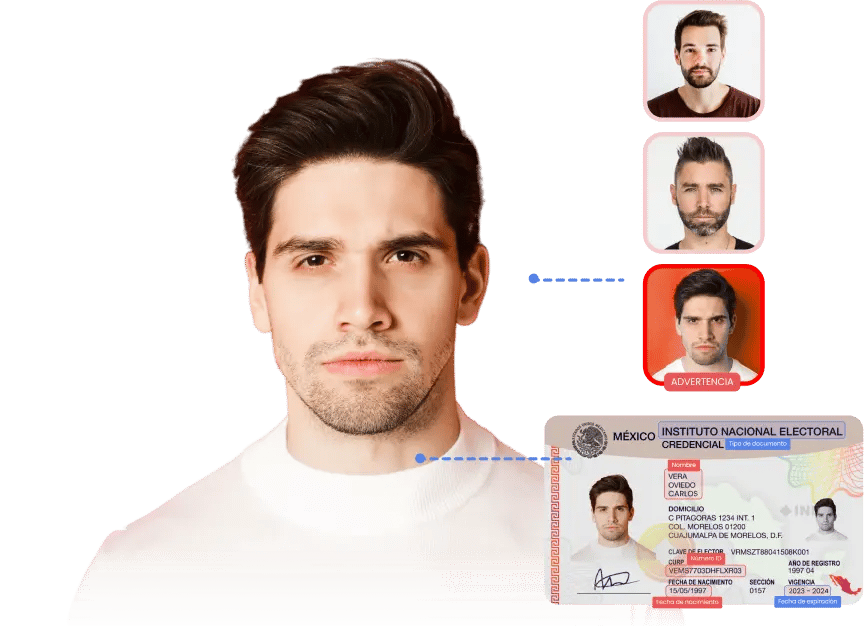

Compare a reference photo with a user’s selfie or video

Our technology compares the user’s selfie or video with the reference image, ensuring they match.

If needed, our team of experts manually reviews failed cases, increasing the conversion rate.

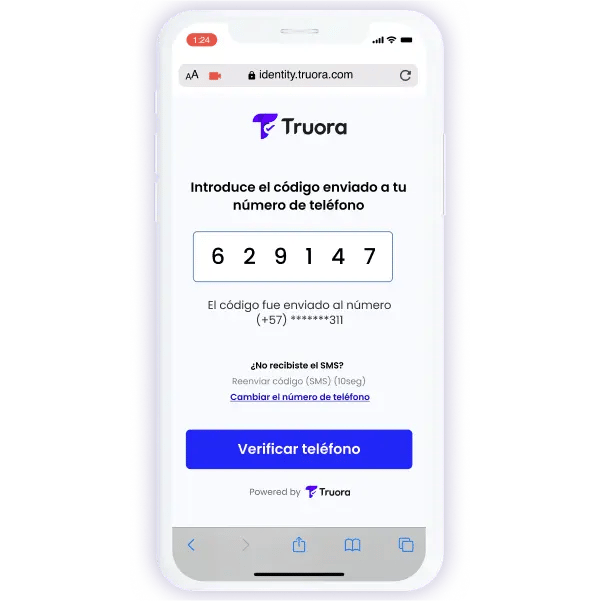

Send a one-time PIN (OTP: One Time Password) to the user's phone number via WhatsApp and/or SMS, requesting their confirmation.

If your business requires it, obtain a trust score for the phone line to filter out fake or suspicious numbers.

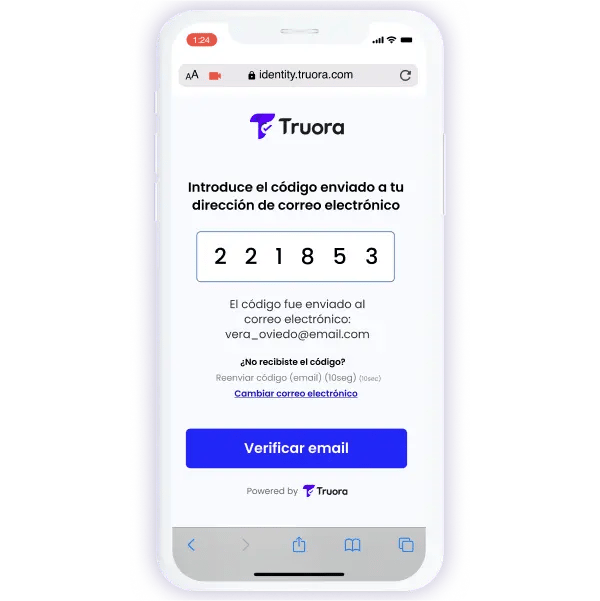

Send a one-time code (OTP) to the user's email and request their confirmation.

We verify the existence of the email address, its syntax, and the risk of bounce.

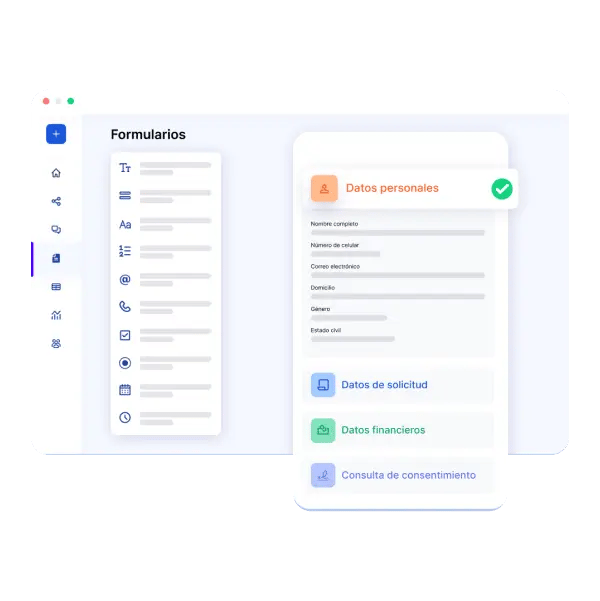

Forms

Capture your customers' data by creating custom forms and integrate them into your workflows to enhance the customer experience.

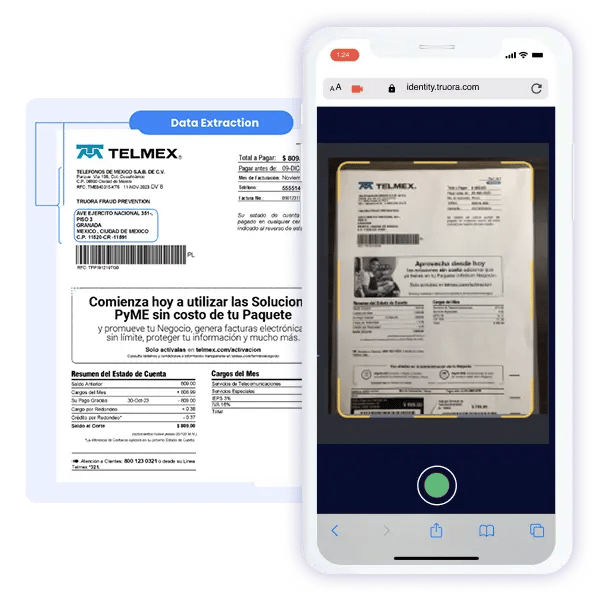

Comprobante de Domicilio

Valida automáticamente la autenticidad y consistencia de los comprobantes de domicilio, asegurando que la información coincida con los datos del usuario.

Verify the authenticity and consistency of users’ identity documents

Fraud Models:

- Data consistency

- Government validation

- Photo-to-photo model

- Color photocopy model

- Black and white photocopy model

Supported documents:

- INE/IFE ID

- FM2/FM3 Residence Card

- Passport

Passive face validation: Compare a reference photo with a user’s selfie or video.

Our technology compares the user’s selfie or video with the reference image, ensuring they match.

If needed, our team of experts manually reviews failed cases, increasing the conversion rate.

Direct Data Collection on WhatsApp

Migrate your data collection processes to WhatsApp and integrate forms directly into your bot conversations, automatically validating the data with instant feedback.

Design your forms directly on the Truora platform to use them in WhatsApp workflows.

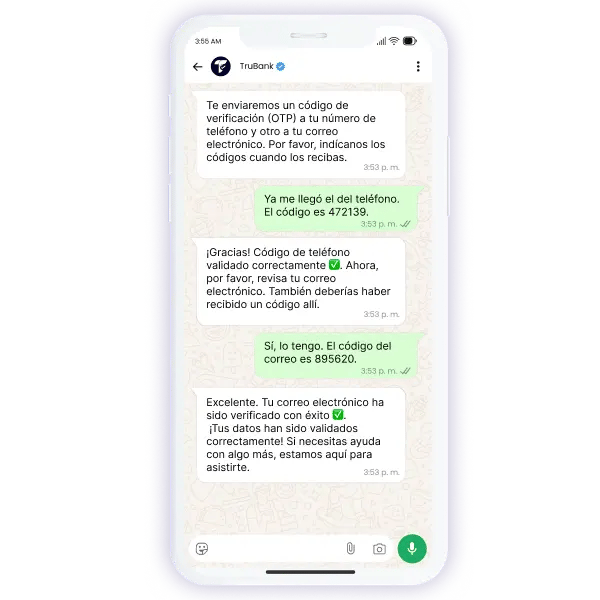

Send a one-time code (OTP) to the user's email/phone and request their confirmation.

We verify the existence of the email address, its syntax, and the bounce risk.

If your business requires it, obtain a trust score for the phone line to filter out fake or suspicious numbers.

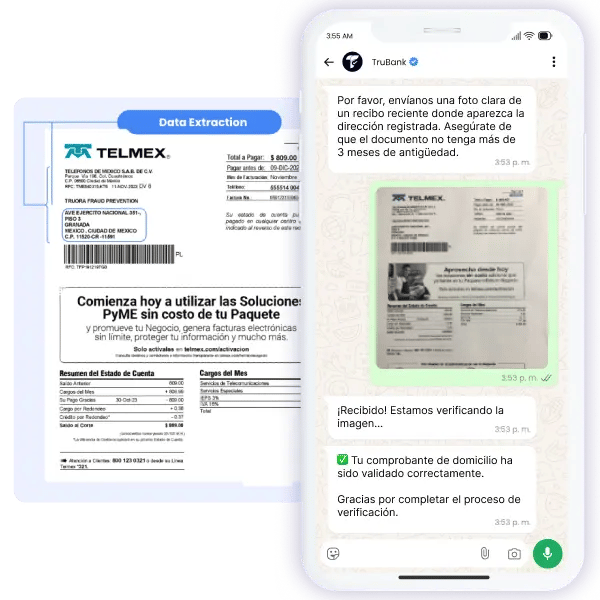

Proof of Address

Automatically validate the authenticity and consistency of proof of address documents, ensuring the information matches the user’s data.

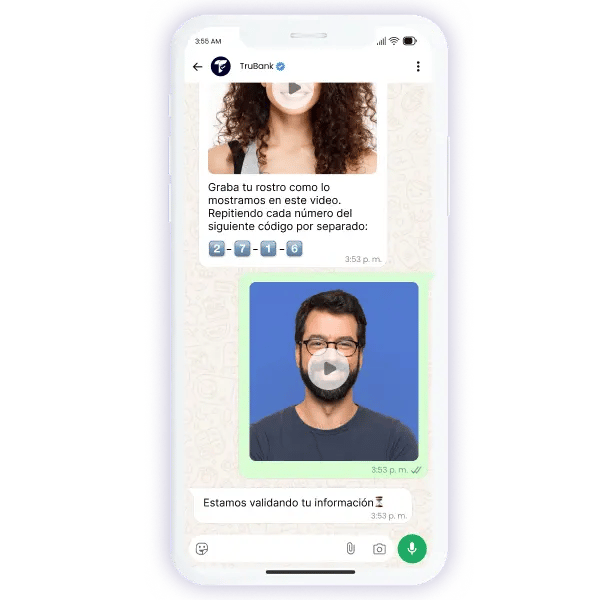

Voice + Face

During the process, the user can submit a live video and simultaneously recite a random code sent to the same WhatsApp conversation.

We receive the code via voice, transcribe it, and compare it with the requested code.

Go beyond visible: Detect frauds that others can’t

.webp?width=308&name=at6iy-755tu%20(1).webp)

Client Information

+Data Processing

This way, each user has a unique, multivariable identity profile.

We simplify the complex: AI-powered solutions, tailored to your needs.

Convert more users

88%

increase in conversion

Prevent fraud

80%

decrease in fraud

Save time and money

+90%

in CDT renewal

Comply with regulations

By using our digital identity validation solution, comply with KYC and AML regulations.

Guarantees safety and confidence

Official government allies

With ready-made solutions for your industry

Identity verification without borders in Latin America

Securely and efficiently validate identities in Mexico, Colombia, Brazil, Chile, Peru, Costa Rica, and El Salvador.

Our platform supports various types of identification to onboard users anywhere.

Thanks to our advanced OCR technology, we guarantee a seamless user experience, regardless of your customers' nationality.

Access the largest database of fraudulent faces in Latin America:

Every time you perform a validation or onboarding, Truface will validate the person's face by checking whether it is reported on the TruFace list.

You will be able to prevent identity fraud and receive alerts about users who have been identified as altering documents.

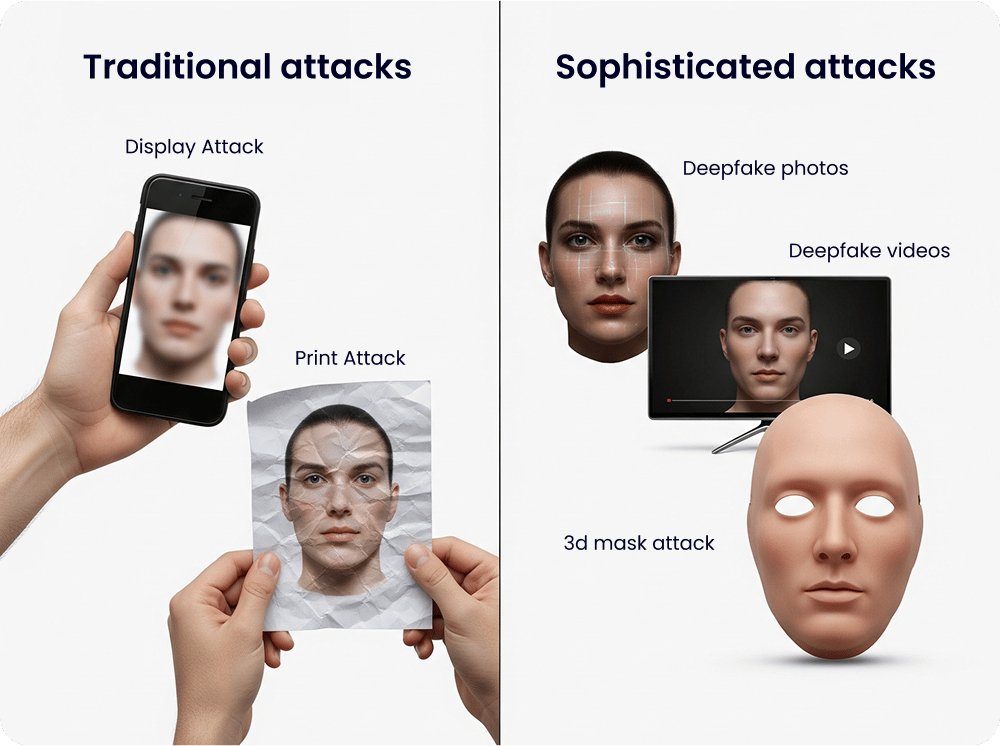

Types of attacks we prevent

- Print Attack: When a scammer takes a photo of a printed photo or document.

- Display attack: When a scammer takes a photo of a digital photo.

- 3D mask attack: When a scammer creates a mask from another person's face.

- Deepfake videos: When a scammer uses software to simulate videos of another face.

- Deepfake photos: When an image has been manipulated or created synthetically using artificial intelligence (AI)

Why trust Truora with the DI verification process?

We have built a strong set of capabilities to provide you a superior verification process

Combine our digital validators with our team of DI experts: Receive support from a specialized ID team to double-check failed validations. This added layer of security increases the success rate of verification.

AI anti-fraud models: We are continuosly training and improving our anti-fraud models to stay one step ahead of fraudsters.

How are our clients using our digital identity verification?

Compliance of KYCKnow Your Customer. Regarding the practices that companies implement to verify their customer's identity and comply with current legal requirements./AMLAnti-Money Laundering. Regarding the business controls to identify or prevent behaviors related to money laundering. for user onboarding

Fincomercio automated and simplified their user onboarding process while being KYCKnow Your Customer. Regarding the practices that companies implement to verify their customer's identity and comply with current legal requirements./AMLAnti-Money Laundering. Regarding the business controls to identify or prevent behaviors related to money laundering. compliant. With our solution Tuya could onboard more users and grow faster.

Industries:

Selling financial products in digital channels

In order to grant loans to its customers securely and through digital channels, Fundación Grupo Social has implemented our identity validators.

Industries:

How to use our solutions ?

API

Web Front

WEB view

Plans and pricing

Included features

Platform for the creation of digital identity validators

Web, WhatsApp and API integration

Customer Support