They trust our judicial background checks

We built an AI-powered suite that enriches your customer profiles with the information your business needs

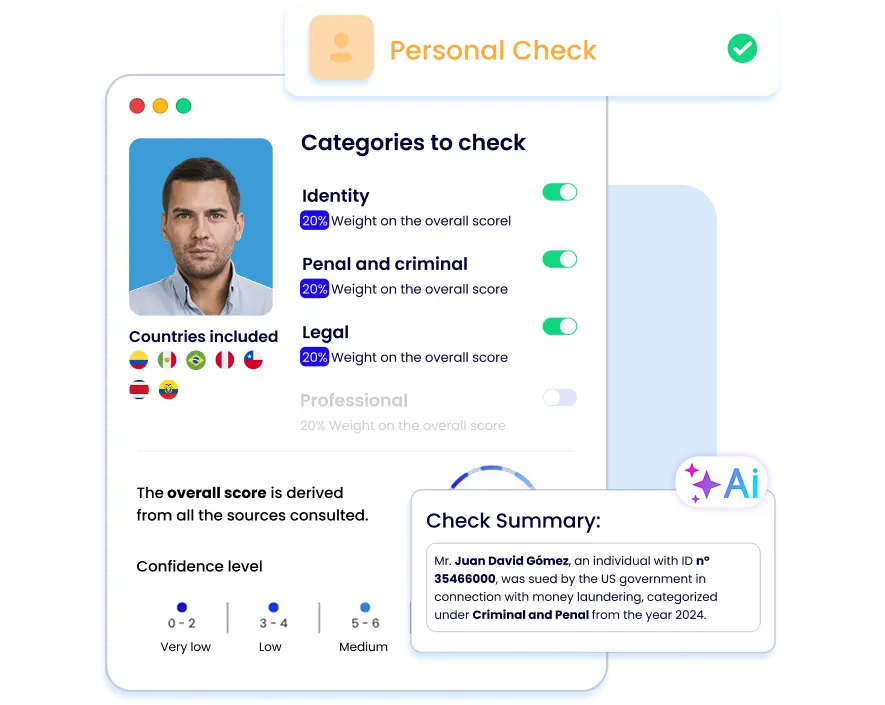

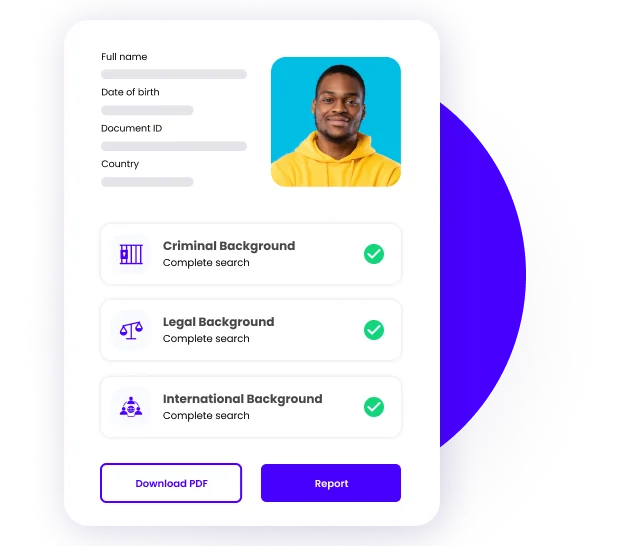

Full identity information

Full identity information

Criminal and judicial background

Criminal and judicial background

Financial profile and creditworthiness

Financial profile and creditworthiness

We simplify the complex: AI-powered solutions, tailored to you.

Convert more users

88%

increase in conversion

Prevent fraud

80%

decrease in fraud

Save time and money

+90%

in CDT renewal

Comply with regulation

Using our digital identity validation solution, comply with KYC and AML regulations.

Guarantee trust and security

.webp)

Start protecting your business:

We have more than 2000 official sources of information in LATAM, to help you protect your business.

Know the main databases by country:

Colombia

- Identity: citizenship card, driver's license.

- Judicial and criminal records: National Police, Attorney General's Office, Judicial processes.

- Business background: Single Tax Registry, Superintendence of Companies, Single Business and Social Registry.

- Other records: International lists, traffic fines, SOAT, politically exposed persons (PEP).

México

- Identity: National Electoral Institute, National Population Registry (RENAPO).

- Judicial and criminal records: Federal and state judiciary, Federal Judicial Council.

- Business background: SAT Certificates.

- Other records: International lists, traffic fines, public vehicle registry, politically exposed persons (PEP), traffic licenses.

Brasil

- Identity: Proof of Cadastral Situation No CPF, Validation of Identity with private deed.

- Judicial and criminal record: Banco Nacional de Monitoramento Penitenciário, Justiça Federal, Certidão Criminal Polícia Federal, Superior Tribunal de Justiça, Supremo Tribunal Federal, Tribunal Regional Federal.

- Other registries: international lists, PEP, SERASA.

Chile

- Identity: Internal Revenue Service, ChileAtiende, Birth Certificates, driver's licenses, RUT, Civil Registry and Identification Service.

- Judicial and criminal record: Supreme Court of Chile, Legal Data Chile, Judiciary, International Police of Chile.

- Business background: Withholding Agent - Internal Revenue Service.

- Other records: international lists, traffic fines, vehicle circulation permit, self-insurance.

Perú

- Identity: Passport, National Registry of Identification and Civil Status, Social Security of Health of Peru, Rutifier Peru.

- Judicial and criminal background: Ministerio de Justicia de Peru, Poder Judicial del Perú, list of most wanted fugitives, Registry of Debtors.

- Business background: Rutifier Peru, National Superintendence of Customs and Tax Administration.

- Other records: traffic fines, driving license, comprehensive health insurance, National Superintendence of Higher University Education.

Costa Rica

- Identity: National Registry, Public Consultation of Electronic Files of Costa Rica, Supreme Court of Elections Republic of Costa Rica.

- Judicial and criminal background: Judicial Power of the Republic of Costa Rica, Judicial Investigation Organism.

- Other records: Consejo de Transporte Público Costa Rica, Ministerio de Hacienda.

International Lists

- FBI

- INTERPOL List of the most wanted

- U.S. Terrorist List

- Most wanted fugitives de la DEA

- U.S. Security and Exchange Commission (SEC)

- United Nations Security Council Consolidated List

- World Bank Debarred Firms

- EU List of the most wanted

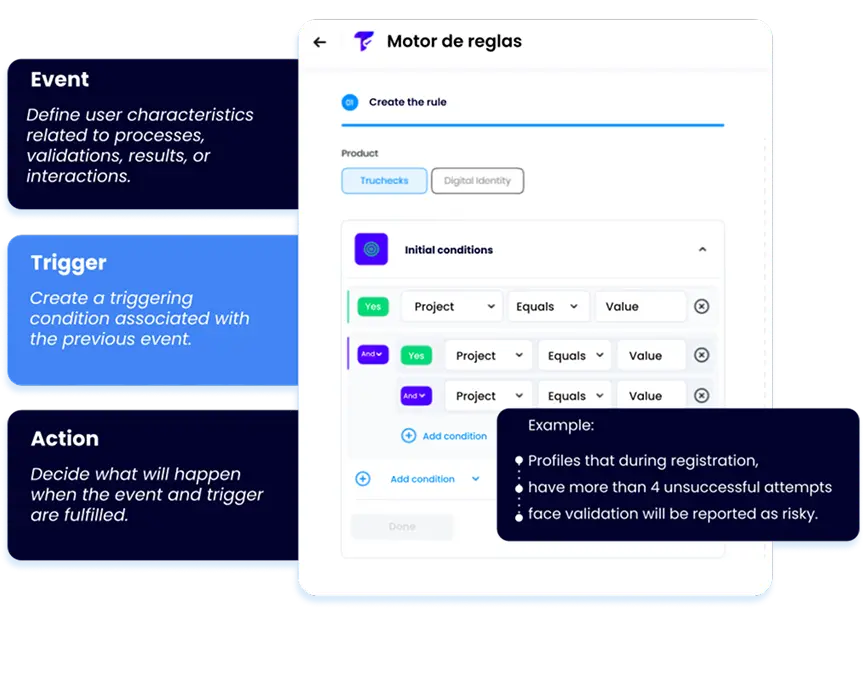

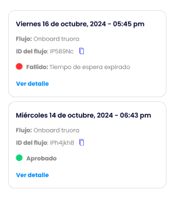

High flexibility and scalability

Types of checks:

Individual

Check individually whenever you need it

Access a detailed summary with relevant variables and information

Identify findings and particularities

Monitor the progress of the check and the status of databases in real-time

Mass

Create large-scale queries with ease

Include background checks for any available country or database

Monitor the progress of the check and the status of databases in real-time

Continuous

Individual or mass checks based on your needs

Monitor and update information from one or multiple checks continuously over time

Ideal for managing large volumes of data consistently

With pre-built solutions tailored to your industry

Go beyond visible: Detect frauds that others can’t

.webp?width=308&name=at6iy-755tu%20(1).webp)

Client Information

+Data Processing

This way, each user has a unique, multivariable identity profile.

Official government partners

Learn how our customers use verification

Secure contracting with accurate information

Rappi decreased the entry rate of unqualified candidates, ensuring the registration of real Rappi-Shopkeepers to the App, thanks to the massive validation of background in criminal and civil lists nationwide.

Industries:

Automation of risk models for granting loans

Through Truora's background check process, ExcelCredit has been able to obtain a credit score from its users to decide whether or not to grant credit, quickly and safely.

Industries:

Maintain the security of your company: start now

Comply with regulations and protect both your business and your customers and employees, accessing our plans for background checks.

Need help or want more than one product? Talk to sales

Plans according to the volume of checks

From 100 checks per month and up to +6000 checks per year

Check online the background of your users, employees and suppliers.